The global networking business depends seriously on the Ethernet switch market, which comprises goods like the Cisco Ethernet switch. Stakeholders must comprehend how the market functions in order to make wise judgments. The latest research from IDC has made an insight into this industry. Sales are predicted to surpass IDC, the leading worldwide market research company, indicating noteworthy growth trends and the rising need for high-speed switching solutions.

Market Overview

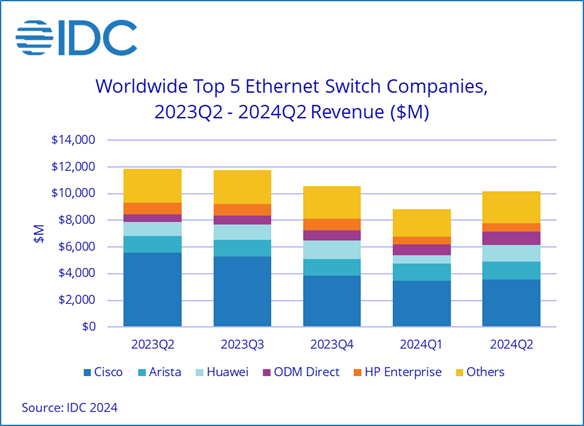

Global Ethernet switch revenue decreased 14.1% year over year to $10.2 billion (about RMB 72.5 billion) in Q1 of 2024, a growth of 15.4%. Concurrently, Q3 2024 had a 30.6% annual decrease in worldwide enterprise and service provider (SP) router sales, amounting to $3.2 billion (approximately equivalent to RMB 22.75 billion).

● What is Ethernet Switch?

A local area network (LAN) is made up of multiple devices connected by an Ethernet switch, a networking equipment. Its data connection layer activity uses MAC addresses to make sure that data is sent to the right place. Ethernet switches are required for efficient network traffic management.

Recent Trends and Statistics

● Significant Decline in Q2 2024

In Q2 2024, the market for Ethernet switches had a significant decrease of 14.1%. This decline is indicative of a difficult market climate. During the same era, the router market saw an even more severe fall of 30.6%.

● Robust Growth in 2023

In contrast, the market for Ethernet switches grew rapidly in 2023, rising by 20.1%. The rising demand for high-speed switching solutions was the primary driver of revenues, which reached $44.2 billion. Following a robust 38.4% annualized growth in Q2 2023, the market saw growth of 15.8% in Q3 2023. (Read IDC: The premier global market intelligence firm. for additional information)

Image Source: pexels

Demand for High-Speed Switching Solutions

● Technological Advancements

Innovations in technology have increased the need for high-speed switching systems. Businesses and service providers make investments in faster platforms to handle workloads for emerging applications like generative artificial intelligence. These expenditures improve the performance and efficiency of the network.

● Market Drivers

The market for high-speed switching systems is driven by various factors. Enhancing data management and accelerating connectivity are essential. Businesses aim to modernize its infrastructure in order to manage growing amounts of data and intricate applications.

Investments in AI

● Impact on Market Growth

AI investments have a big impact on the Ethernet switch market’s expansion. Forecasts show that in the upcoming years, the amount will increase from $640 million in 2023 to over $9 billion. AI innovations improve network performance and increase the need for sophisticated switching solutions.

● Key Innovations

Important advances in AI support market growth. These developments make it possible to handle data more effectively and manage networks better. AI integration provides improved scalability and performance for networking systems.

Key Players in the Ethernet Switch Market

Major Companies

● Market Range

- Cisco

Ethernet switch revenue for Cisco rose 2.1% in the most recent quarter but fell 36.6% in the year prior. Cisco’s market share for Ethernet switches dropped from 47.1% in the same period in 2023 to 34.8% in the second quarter of 2024. Compared to the same period previous year, Cisco’s income from enterprise routers and service providers fell by 39.2%. For Ethernet switches made by Cisco, there is market certification. The WS-C2960X-24PS-L is a highly recommended option as it offers 24 Gigabit Ethernet ports with PoE+ and exceptional overall functionality.

- Arista

Arista Networks’ Ethernet switch revenue climbed by 7.0% in Q2 2024 and 12.4% year over year to take a 13.5% market share in the same quarter, with 90.2% of its revenue coming from data centers.

- Huawei

Huawei’s total Ethernet switch revenue grew 15.5% year-over-year and 100.9% quarter-over-quarter, reaching a market share of 12.0%. The company’s revenue from enterprise routers and service providers fell by 36.6% year over year in Q2 2024, leaving it with a 30.4% market share.

- HPE

An yearly decline of 25.2% was followed by a quarterly growth of 6.5% in HPE’s revenue from Ethernet switches (86.2% of which came from sources outside of data centers), resulting in a 6.2% market share.

- H3C

By the conclusion of 2024’s second quarter, H3C’s Ethernet switch revenues had increased by 30.3% from the previous quarter and dropped by 3.7% from the previous year, giving it a 4.5% market share. In the service provider and enterprise routing industry, H3C held a 2.9% market share and saw a 1.7% fall in revenues year over year.

● Cisco Ethernet Switch: Role and Contributions

One major player in the Ethernet switch market is Cisco. The business is a technological and innovative pioneer. When it comes to dependability and performance, the Cisco Ethernet switch is the greatest option available. Cisco provides scalable networking solutions for businesses. The company services many industries with its wide range of products.

Emerging Players

● New Entrants

The Ethernet switch market is changing due to new competitors, such as Ubiquiti, Netonix and Cumulus. These businesses provide new ideas and innovations. Their arrival brings with it fresh prospects and competition. New entrants frequently aim for specialized markets. They are able to get traction in the market thanks to this tactic.

● Strategic Partnerships

Market dynamics are improved via strategic alliances. Innovation is fostered when established and fledgling companies collaborate. Technology trade and resource sharing are made possible via partnerships. Ethernet switching solution developments are fueled by these agreements. Enhanced innovation and efficiency help the market.

Geographic Trends and Regional Performance

Market Dynamics Overview

● North America’s Leading Position

In terms of the market for Ethernet switches, North America is leading. Of USD 5,950.99 million in revenue in 2022, the region was the largest contributor. Growing to USD 8,509.38 million by 2030, according to projections. 65.40% of the revenue in 2022 came from the United States, a major contribution. This expansion is fueled by a huge number of cloud service providers and data centers. It’s still very popular to need cutting edge networking solutions. (Read Ethernet Switch Market – Size, Industry Share, Growth Trends and Forecasts (2023 – 2030) for additional information)

● Emerging Trends in Asia-Pacific Region

The market for Ethernet switches is competitive in Europe. The market had an annual growth of 49.1%. Europe’s Central and Eastern regions saw notable growth of 60.8%. With a 44.0% increase, Western Europe likewise had a favorable trend. Competition stems from the need for creative networking solutions. To gain market share, businesses concentrate on growing the range of products they offer.

Regional Landscape Analysis

● Competitive Scenario in Europe

In the Ethernet switch market, Europe offers a competitive environment. Year over year, the market increased by 49.1%. Significant growth of 60.8% was seen in Central and Eastern Europe. With a gain of 44.0%, Western Europe likewise saw a positive trend. Competition is driven by the need for novel networking solutions. Companies concentrate on growing the range of products they offer in order to gain market share.

● Growth Opportunities in Latin America

There are good development prospects in the Ethernet switch industry in Latin America. Revenues increased by an astounding 88.3% in the region. This expansion indicates the possibility for more growth. Technology and infrastructural investments support the growth of the market. Businesses investigate novel approaches to leverage these prospects. Leaders in the industry are drawn to the region because of its dynamic market environment.

Conclusion

The market for Ethernet switches has a bright future. Advanced switches have been introduced to meet the needs of commercial and industrial applications. Growth in the market is mostly driven by this tendency. Businesses and service providers make investments in faster networks. These investments help to support emerging uses, like workloads related to generative AI.

The Ethernet switch market showcases a promising trajectory. Key players drive innovation, enhancing network efficiency and performance. The market anticipates a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. Projections suggest the market will reach USD 73.87 billion by 2030. North America maintains a stronghold, while Asia-Pacific and Europe exhibit dynamic growth. Latin America offers substantial expansion opportunities.

Discover the power of connectivity with Router-switch.com, your trusted partner in networking solutions for over 22 years. Our commitment to excellence ensures you receive top-notch Ethernet switches at the most competitive prices. Experience seamless performance, robust security, and unmatched reliability with our products and services.