On July 28, 2023, Gartner released its Q1 2023 Storage Market Review, indicating a decline in market share for NetApp and Pure Storage. The total revenue of the all-flash array market reached $2.523 billion (180.38 RMB), accounting for 50.4% of the entire storage market with a 4% YoY growth in currency.

On July 28, 2023, Gartner released its Q1 2023 Storage Market Review, indicating a decline in market share for NetApp and Pure Storage. The total revenue of the all-flash array market reached $2.523 billion (180.38 RMB), accounting for 50.4% of the entire storage market with a 4% YoY growth in currency.

However, there was a significant drop of 22% compared to the previous quarter. Flash storage occupied 31% of the total shipment capacity, showing notable growth from 18.2% in the previous quarter and 16.8% from the same period last year.

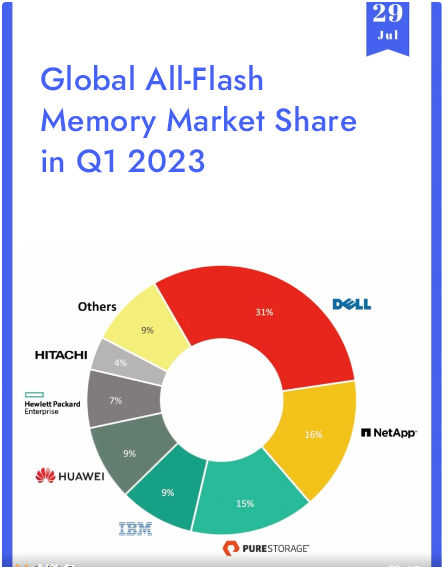

According to analyst Aaron Rakers from Wells Fargo, Dell’s flash revenue grew 17% YoY and 12% QoQ, while HPE also witnessed a 17% YoY growth in all-flash revenue. In contrast, Pure Storage’s revenue declined 10% YoY and a substantial 24% QoQ, resulting in its all-flash array (AFA) market share dropping from 17.7% a year ago to the current 15.4%.

Rakers further noted that Pure Storage’s all-flash capacity share was 624 EB, a 5% YoY increase but relatively unchanged compared to last year’s 4.7%.

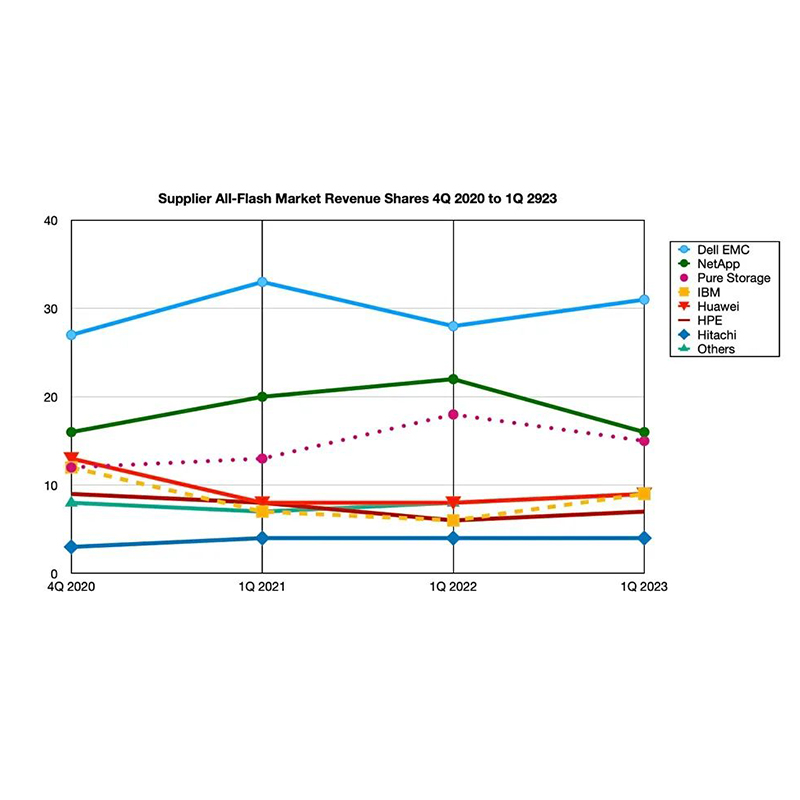

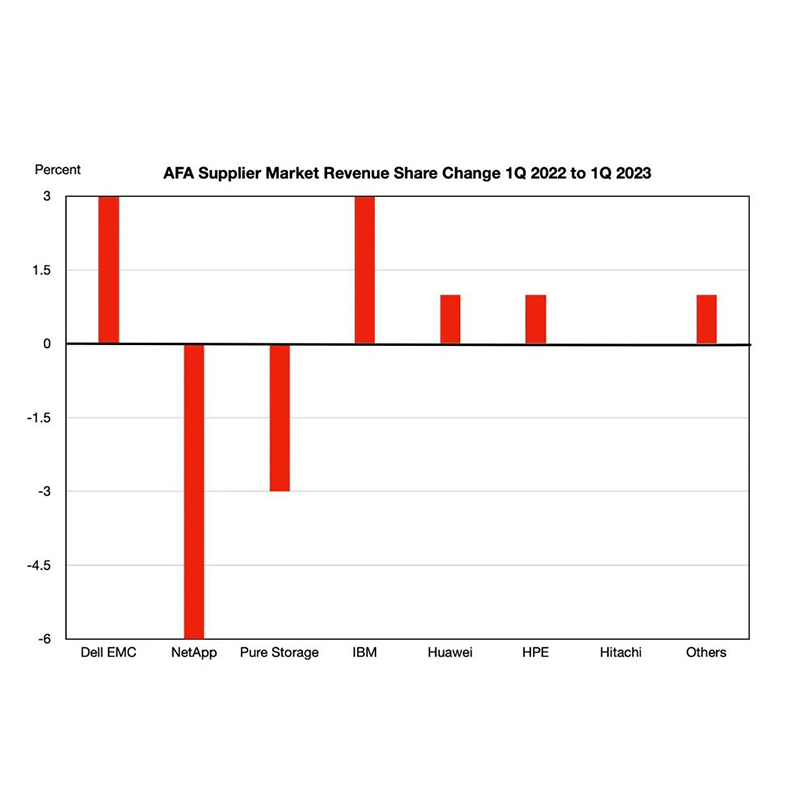

Although detailed changes in other vendors’ shares were not disclosed, previous data from IT media website Black & Files showed that NetApp’s market share decreased from 22% a year ago to 16% in Q1 2023. Pure Storage also experienced a decline in market share but not as significant, indicating it narrowed the gap with NetApp. Meanwhile, IBM has been striving to catch up with Huawei and is gradually distancing itself from HPE.

Companies with YoY revenue share growth include Dell EMC, IBM, Huawei, HPE, and “Other Vendors.” These changes in revenue shares have been illustrated through charts.

Overall, both NetApp and Pure Storage lost market share to other players in the storage market.

Other performances in the storage market

Regarding the overall storage market, Gartner reported a market size of $5.05 billion, with a 1% YoY growth. Primary storage saw a 1% YoY growth, while secondary storage and backup recovery increased by 4% and 9%, respectively.

Hybrid flash/disk and disk revenues declined by 2% YoY. The total external storage capacity grew by 24% YoY, with secondary storage capacity experiencing significant growth of 70%, backup storage growing by 18%, and primary storage capacity only growing by 3%.

For more insights and to stay ahead in the evolving storage landscape, visit Router-switch website and explore our diverse range of premium storage solutions. Unlock the potential of your IT infrastructure and achieve business success with our exclusive offers on cutting-edge networking equipment. Upgrade to excellence with Router-switch now!

Check More Router-Switch Products:

Read More:

Igniting the Future of ICT: An Invitation to Router-switch.com’s InnovateTech Speaker Program