According to the latest data from IDC, spending on cloud computing and storage infrastructure products continued to grow strongly in the first quarter of 2023, reaching $21.5 billion, a year-on-year increase of 14.9%. This shows that the demand for cloud services by enterprises and organizations continues to grow, and more and more companies are moving their IT infrastructure to the cloud to improve efficiency and flexibility.

According to the latest data from IDC, spending on cloud computing and storage infrastructure products continued to grow strongly in the first quarter of 2023, reaching $21.5 billion, a year-on-year increase of 14.9%. This shows that the demand for cloud services by enterprises and organizations continues to grow, and more and more companies are moving their IT infrastructure to the cloud to improve efficiency and flexibility.

Meanwhile, non-cloud computing infrastructure declined 0.9% over the same period, with spending of $13.8 billion. This also reflects that many enterprises are gradually turning to cloud computing to adapt to changing market demands and business challenges. The unit demand of the cloud infrastructure sector fell by 11.4%, but the average selling price (ASP) increased by 29.7%, showing the high value-added of cloud computing services and the fierce competition in the market.

Spending on shared cloud infrastructure reached $15.7 billion in the quarter, up 22.5% year-over-year. The growth of shared cloud infrastructure shows the demand of enterprises for elastic computing and resource sharing, which enables enterprises to flexibly adjust computing resources according to business needs and avoid over-investment.

The private cloud infrastructure segment, on the other hand, declined 1.5% year-over-year to $5.8 billion in the first quarter of 2013. However, 44.5% of private cloud infrastructure is deployed on the client side, showing that some enterprises still prefer to deploy sensitive data and applications in a private cloud environment to meet data security and compliance requirements.

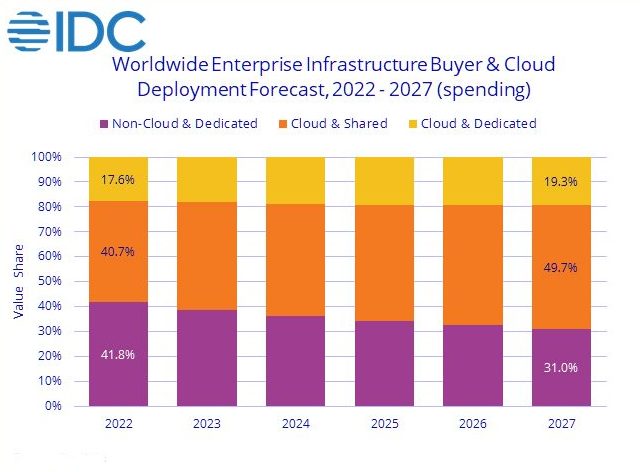

According to IDC’s forecast, cloud infrastructure spending will continue to grow by 7.3% in 2023, reaching $96.4 billion, a slight improvement from the previous forecast of 6.9%. Non-cloud infrastructure is expected to decline 6.3 percent to $60.4 billion. This shows that the cloud computing market will continue to maintain steady growth, while the traditional infrastructure market is facing some challenges and pressures.

Shared cloud infrastructure is expected to grow 8.4% year-over-year to $68.0 billion for the year, while spending on dedicated cloud infrastructure is expected to grow 4.8% to $28.4 billion for the year. This shows that enterprises have an increasing demand for both shared and dedicated cloud infrastructure, as different business scenarios and application requirements may require different types of cloud services.

IDC tracks various types of service providers and how much computing and storage infrastructure those service providers have purchased, both cloud and non-cloud. In the first quarter of 2023, service providers as a whole spent $21.5 billion on computing and storage infrastructure, a year-on-year increase of 14.6%. This shows that cloud service providers are playing an increasingly important role in the cloud computing market, providing enterprises with a wealth of cloud services and solutions.

Geographically, spending in Central and Eastern Europe was down 27.1% year-over-year, China was down 20.4%, and Canada was down 4.9%. This may be related to the local economic conditions and the stage of market development. Latin America, the United States, the Middle East and Africa (MEA), Japan, and Asia Pacific (excluding Japan and China) (APeJC) recorded growth rates of 39.2%, 34.3%, 33.5%, 17.1%, and 16.4%, respectively. This shows that the cloud computing market in the Asia-Pacific region has great potential and has become a major growth engine for the global cloud computing market.

IDC predicts that in the long run, spending on cloud infrastructure will grow at a compound annual growth rate (CAGR) of 11.2% over the forecast period 2022-2027, reaching $153 billion in 2027, accounting for 69.0% of total spending on computing and storage infrastructure. This shows that the continuous development of cloud computing will become the main trend of the IT industry in the next few years, bringing more innovation and development opportunities for enterprises.The above content is quoted from IDC.

Want to know more cloud computing products and solutions, please visit our website Router-switch.

Check More Router-switch Products:

Read More:

Igniting the Future of ICT: An Invitation to Router-switch.com’s InnovateTech Speaker Program