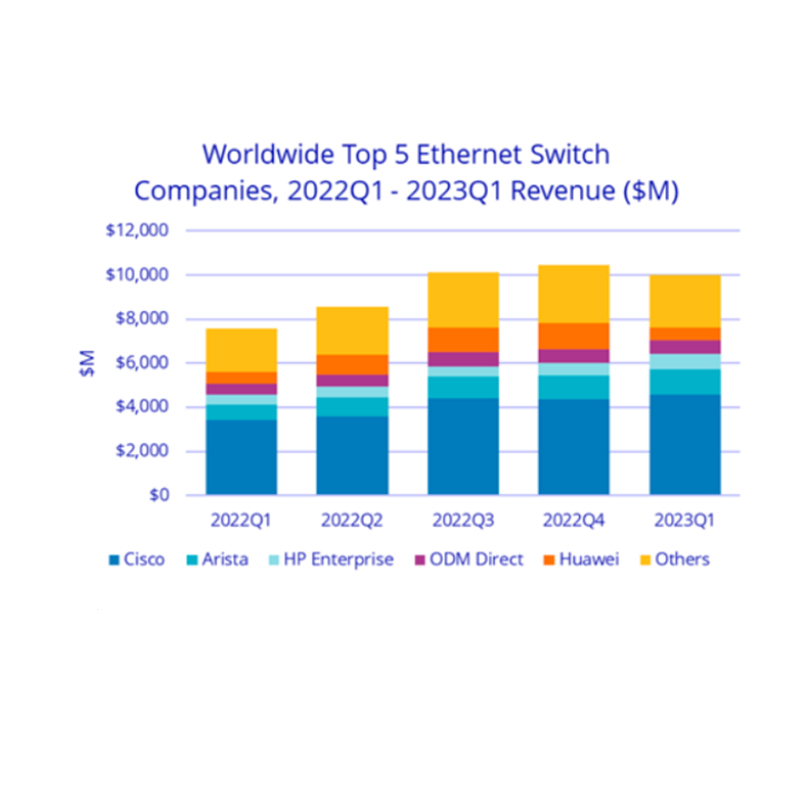

The latest IDC report has indicated the market share of top enterprise switch suppliers during the first quarter of 2023.

The latest IDC report has indicated the market share of top enterprise switch suppliers during the first quarter of 2023.

The Ethernet switch market grew revenues 31.5 percent in the first quarter of 2023 (1Q23) to $10 billion.

The revenue of enterprise and service provider (SP) router market rose 14.1 percent to $4.1 billion in the first quarter.

The Ethernet switch market showed strength across both the datacenter and non-datacenter segments of the market.

Revenues in the non-datacenter/enterprise campus and branch segment grew 38.7 percent, while port shipments rose 14.1 percent. Revenues in the datacenter portion of the Ethernet switch market rose 23.2 percent in 1Q23, while port shipments increased 19.7 percent.

Revenues for 200/400 GbE switches rose 141.3 percent annually in 1Q23 and were up 14.3 percent sequentially from 4Q22 to 1Q23. 100GbE revenues increased 18.2 percent year over year in 1Q23. 25/50 GbE revenues increased 21.1 percent in 1Q23.

Lower-speed switches, commonly utilized in enterprise campus and branch setups, demonstrated notable growth as well. The revenue for 1GbE switches increased by 43.7 percent in the first quarter of 2023. Similarly, 10GbE switches experienced a rise of 9.7 percent during the same period. Notably, multi-gigabit Ethernet switches (2.5/5GbE) recorded an impressive surge of 128.0 percent in revenue in 1Q23..

Ethernet switch market growth

Asia Pacific +31.8 percent

China –5 percent

United States +40.3 percent

Canada +39.1 percent

Latin America +65.3 percent

Western Europe +36.1 percent

Central and Eastern Europe +16.4 percent

Middle East & Africa +40.4 percent

Router Market Highlights

The service provider segment, which includes both communications SPs and cloud SPs, accounted for 77.7 percent of the market’s total revenues. The service provider segment of the market increased 13.1 percent in 1Q23.

Revenues in the enterprise segment account for the remaining share of the market and rose 17.6 percent compared to the first quarter of 2022.

Cisco’s Ethernet switch revenues increased 33.7 percent in 1Q23, giving the company a market share of 46 percent. Cisco’s combined service provider and enterprise router revenue grew 18.2 percent in the quarter, giving the company a market share of 37.9 percent in 1Q23.

Arista Networks saw Ethernet switch revenues increase 61.6 percent in 1Q23, giving the company 11.4 percent market share.

Huawei’s Ethernet switch revenue increased 5.5 percent in 1Q23, giving the company a market share of 6.0 percent. The company’s combined SP and enterprise router revenue rose 2.7 percent, giving the company a market share of 23.6 percent in the quarter.

HPE’s Ethernet switch revenue increased 54.9 percent in 1Q23, resulting in a market share of 7.0 percent.

In 1Q23, H3C experienced a 15 percent decline in Ethernet switch revenue, leading to a market share of 3.6 percent. The combined service provider and enterprise routing market also saw a decrease of 10.3 percent in H3C’s revenues during the same period, resulting in a market share of 1.6 percent.

Don’t miss out on enhancing your network solutions with Router-switch’s premium products. As a system integrator, you can find the best Ethernet switches and routing solutions to meet your clients’ demands. Act now and visit our website to make the most of exclusive offers and elevate your business success today!

Check More Router-Switch Products:

Read More:

Igniting the Future of ICT: An Invitation to Router-switch.com’s InnovateTech Speaker Program