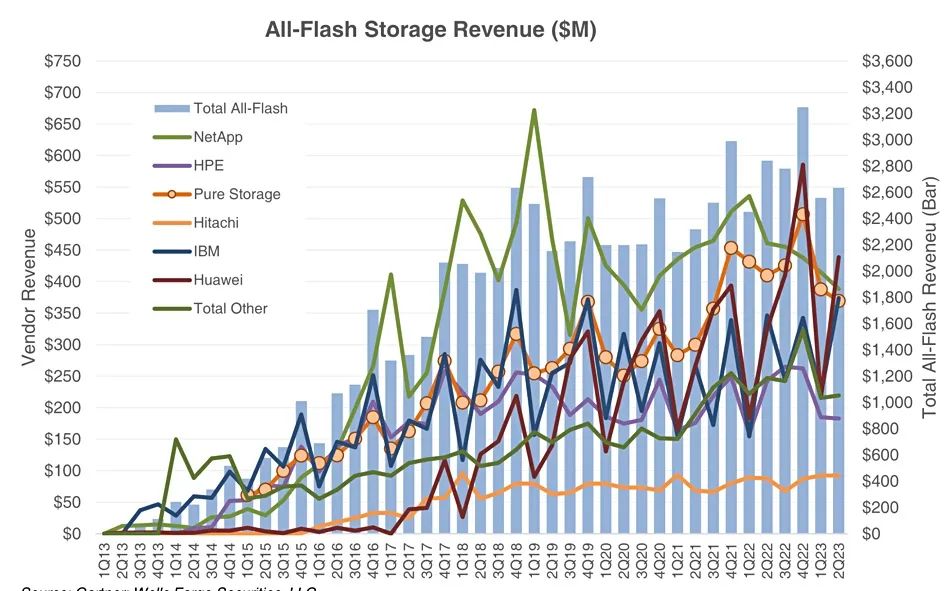

The external storage market is experiencing significant shifts, with some players making substantial gains while others face challenges. According to the latest data from Gartner, the entire all-flash array market saw a year-on-year decline of 7%, totaling $2.635 billion. In contrast, some vendors have managed to thrive in this evolving landscape. Let’s delve into the details and explore the key takeaways from Gartner’s recent report.

The Decline in External Storage Market

Gartner’s report reveals that the overall external storage revenue dropped by 14% year-on-year, amounting to $5.029 billion. This decline can be attributed to a 15% reduction in primary storage revenue, a 7% decrease in secondary storage revenue, and a significant 20% plunge in backup and recovery revenue.

One noteworthy trend is the decline in revenue for traditional hard disk drives (HDD) and hybrid arrays, down by 21%. This segment once held a substantial 47.6% share of the entire market, but it’s now being replaced by all-flash arrays.

The Rise of Key Players

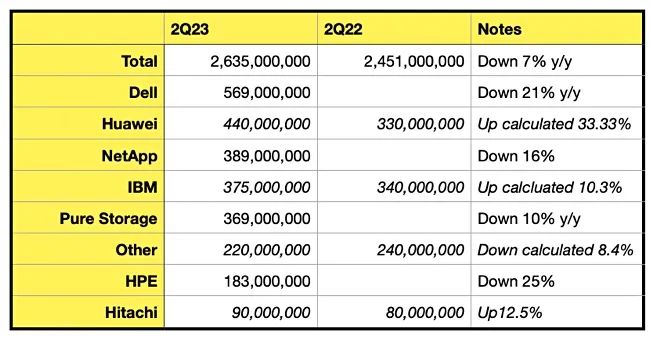

Despite the market’s overall decline, certain vendors have managed to make remarkable strides. Leading the pack is Dell, with revenue totaling $569 million, securing its position as the market leader. Huawei follows closely behind, experiencing an impressive 33% growth. Other notable performers include IBM, NetApp, Pure Storage, and HPE.

Here’s a snapshot of the all-flash storage revenue of key players (in millions of USD):

A Closer Look at Key Players

Huawei and IBM Shine

Huawei and IBM have seen substantial growth in their all-flash array revenue. Huawei’s performance is particularly noteworthy, as it has surpassed NetApp and Pure Storage. While Dell’s revenue isn’t featured in the graph, it’s essential to acknowledge its leadership in the market.

Pure Storage Faces Challenges

Pure Storage, on the other hand, experienced a decline in market share, dropping from 15.2% in the previous quarter to 14%. Its market share has now fallen below that of NetApp for the second consecutive quarter, with revenue also lower than the fourth quarter of 2021.

Aaron Rakers, an analyst at Wells Fargo, estimates that Pure Storage’s FlashArray revenue was $283 million, marking a 15% year-on-year decrease. In contrast, FlashBlade revenue reached $86 million, reflecting a 13% year-on-year growth.

NetApp Struggles

NetApp faced a decline in revenue greater than the market average, with a 16% year-on-year drop in all-flash array revenue. Its hybrid/HDD array revenue performed even worse, plummeting by 47%. Rakers noted that NetApp’s market share had fallen to a low of 9.7%, the lowest since 2009, down from 11.1% in the same period the previous year.

HPE and Hitachi Face Challenges

HPE experienced a sharp 25% year-on-year drop in all-flash array revenue, totaling $183 million. In contrast, Hitachi’s all-flash array revenue amounted to $90 million, marking a 12.5% year-on-year growth.

The Cost Factor

Gartner also considers the average selling price (ASP) when assessing the market. The cost of all-flash array storage is now 4.3 times that of hybrid/HDD storage, a decrease from 4.8 times a year ago. This shift brings it in line with prices seen around the end of 2019.

In conclusion, while the external storage market is undergoing a transformation, some players are thriving by adapting to changing dynamics and customer demands. The decline in traditional storage solutions like HDDs and hybrid arrays is evident, with all-flash arrays becoming the new standard. Dell’s leadership in the market and the impressive growth of vendors like Huawei and IBM demonstrate the ongoing evolution of the storage industry.

For a comprehensive range of cutting-edge storage solutions and to explore how these market trends can benefit your organization, visit Router-switch.com. Our team of experts is ready to assist you in making informed decisions that drive your business forward.

Don’t miss out on the opportunity to stay ahead in the ever-evolving world of storage technology. Act now and unlock the future of your storage infrastructure with Router-switch.com.

Read More:

Expand Your Business Horizons by Becoming a Supplier of Router-switch.com

Smart Cities with ICT Infrastructure: Cisco, IBM, Oracle, and Huawei Lead the Way