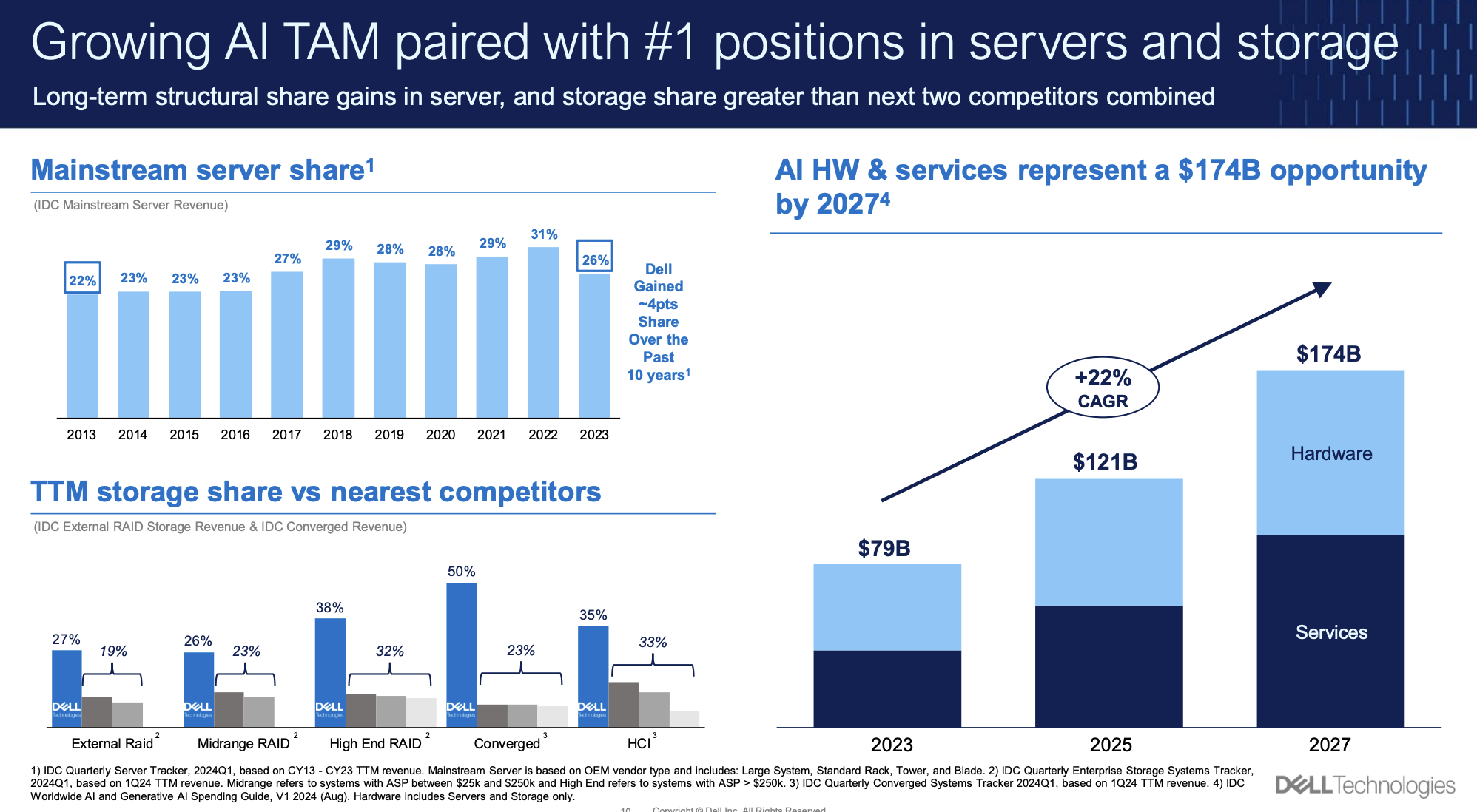

Dell Technologies holds a dominant market share of 31.5% in the external corporate storage space worldwide. But DELL’s storage revenue has just decreased by 5%. Dell is confident about its future growth despite this setback because it is concentrating on leveraging AI to spur innovation and income. The organization wants to demonstrate its dedication to responding to changing market demands by using the demand for AI to improve its financial performance.

Current Financial Performance

Analysis of Storage Revenue Decline

Image Resource: DellTechnologies

Image Resource: DellTechnologies

● Factors Contributing to the 5% Drop

Dell Technologies experienced a 5% decline in storage revenue. There were other variables that led to this decline. Revenue on the worldwide storage systems market fell by 7% in 2023. Even with its dominant revenue share, Dell was unable to buck the trend. The growing need for AI servers also contributed. This change took focus and funding away from conventional storage options. Consequently, the emphasis on AI had an effect on Dell’s storage business.

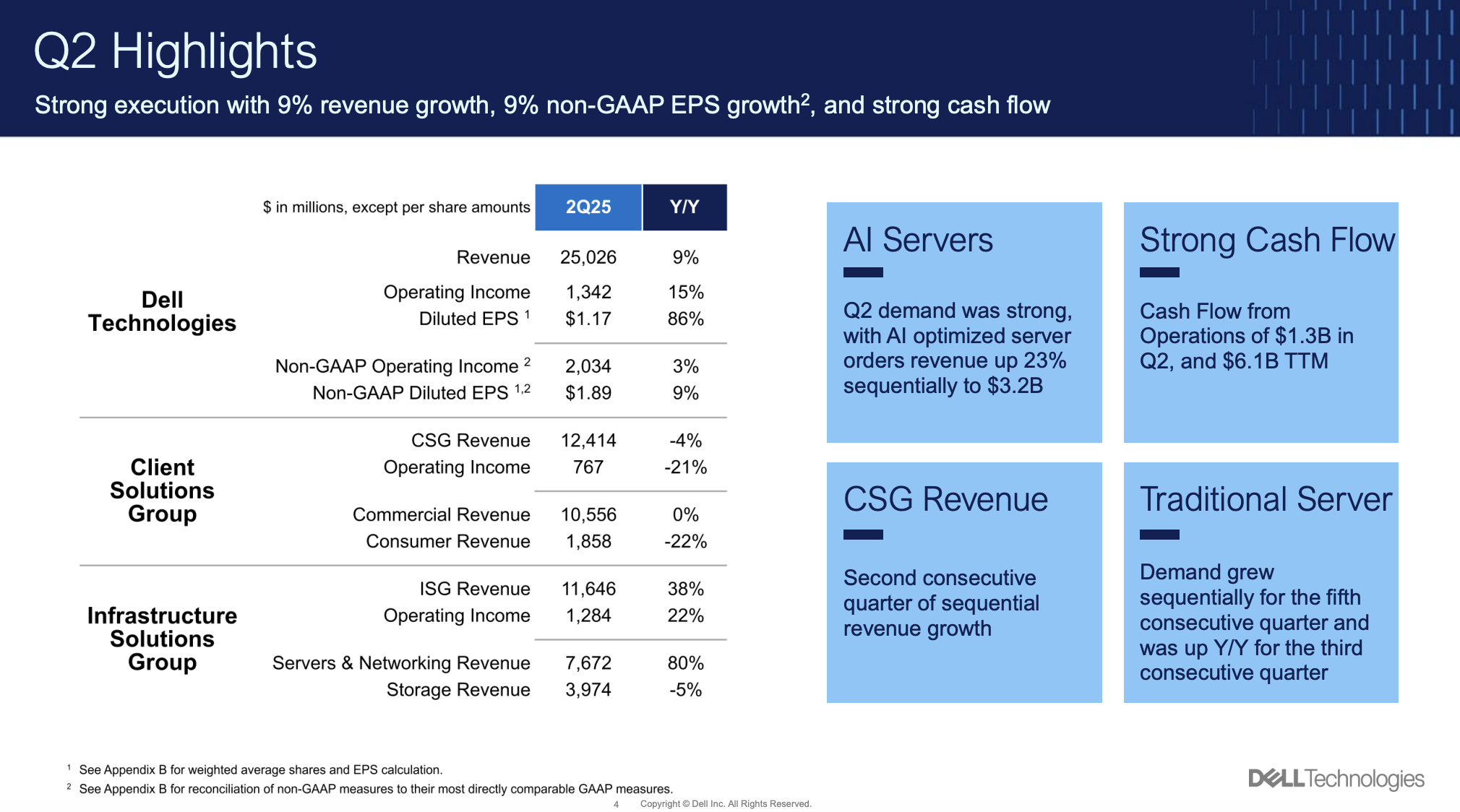

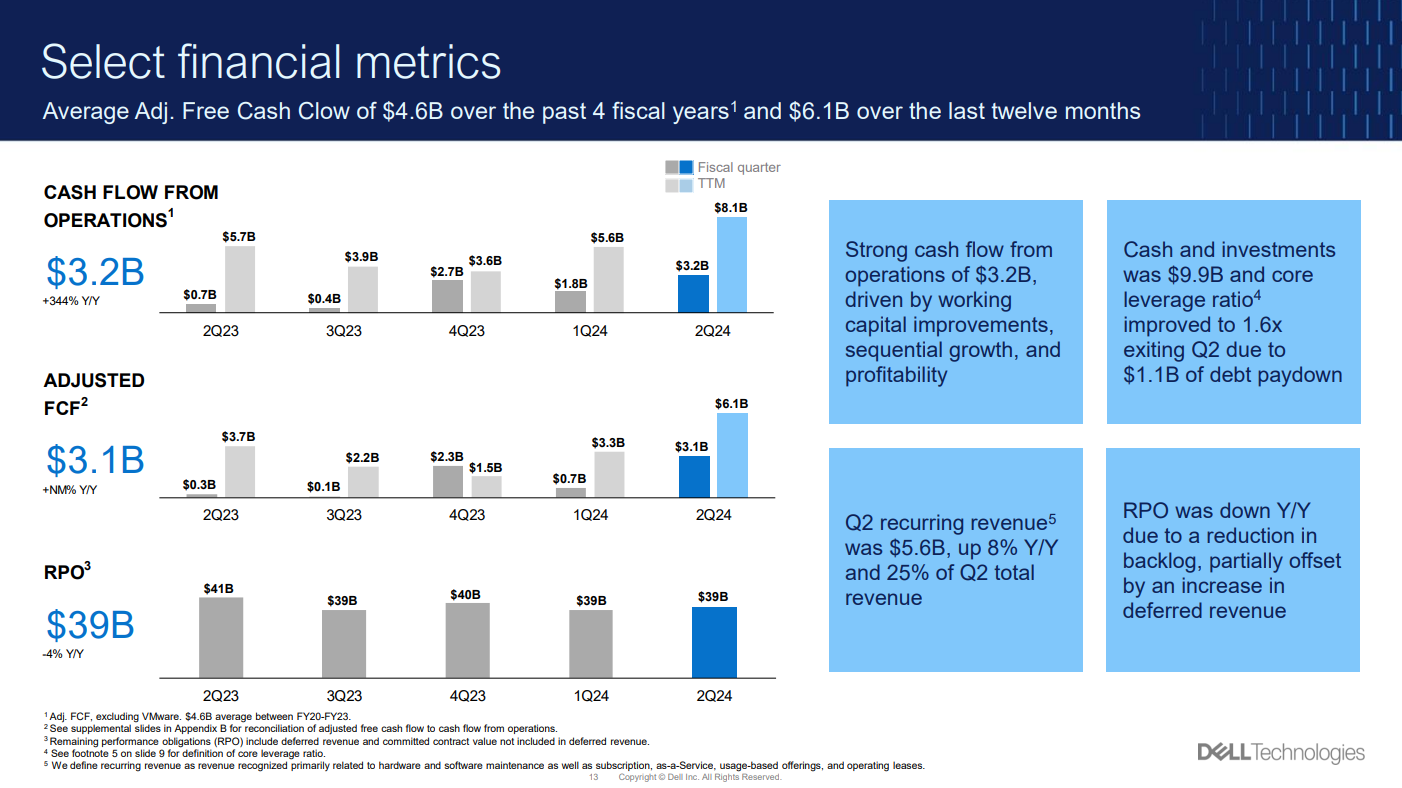

● Impact on Overall Financial Health

Dell’s entire financial situation was impacted by the decrease in storage sales. Dell reported a 6% gain in overall revenue for the first quarter of fiscal 2025 in spite of this setback. The business’s profitability demonstrated tenacity. Year over year, Dell’s net income increased by 84.84%. With a return on invested capital (ROIC) of 21.48%, the weighted average cost of capital (WACC) of 7.25% was greatly outperformed. These measures show a high level of financial effectiveness. Dell was able to offset the impact of the reduction in storage revenue by continuing to grow in other areas.

Other Financial Metrics

Image Resource: DellTechnologies

Image Resource: DellTechnologies

● Revenue from Other Segments

For the second quarter of FY25, Dell’s Client Solutions Group (CSG) revealed a 4% drop in revenue year over year. Revenue from commercial clients, consumers, and storage all saw decreases. In the second quarter of 2024, Dell’s overall sales climbed by 9.12% year over year in spite of these obstacles. This expansion was facilitated by the company’s emphasis on AI and other cutting-edge solutions. Dell made calculated bets in cutting-edge technologies to partially offset its losses in more established markets.

● Comparison with Competitors

When comparing its financial performance to that of its rivals, Dell stands out. The company’s WACC of 7.25% is greatly outperformed by its ROIC of 21.48%. This ratio demonstrates Dell’s economical viability. In contrast, competitors with lower ROIC/WACC ratios—such as Cisco Systems and Oracle Corporation—do not compare to Dell. Dell’s strategic competence is demonstrated by its ability to sustain growth and profitability in a highly competitive market. The company is well-positioned for future success because of its concentration on AI.

(Read Dell Technologies Fiscal Year 2024 Second Quarter Results for more information)

Strategic Shift Towards AI

Reasons for Betting on AI

● Market Trends in AI

The global market for AI continues to expand rapidly. Businesses across various sectors invest heavily in AI technologies. The demand for AI-driven solutions grows as companies seek efficiency and innovation. Dell recognizes this trend and positions itself to capitalize on these opportunities. The focus on AI aligns with the company’s strategic goals. Industry analysts predict significant growth in AI applications, driving future revenue streams.

● Dell’s AI Product Offerings

Dell offers a comprehensive range of AI products. The company provides solutions that cater to diverse business needs. Dell’s AI Factory plays a crucial role in this strategy. The AI Factory includes a collection of advanced technologies and an open ecosystem of partners. Dell’s offerings aim to accelerate business outcomes and maximize resources. The portfolio includes infrastructure, collaborations, and expert services. These elements help businesses achieve AI outcomes more efficiently.

Investment in AI Technologies

● Recent Acquisitions and Partnerships

To improve its AI capabilities, Dell actively seeks collaborations and acquisitions. The organization works in conjunction with top IT companies to include state-of-the-art technologies. Dell’s presence in the AI sector is increased by these alliances. The company’s technological capabilities are reinforced by recent acquisitions. Building a strong ecosystem is the main goal of Dell’s approach. This strategy guarantees access to the most recent advancements and knowledge.

● Research and Development Initiatives

Research and development is an area in which Dell invests heavily. The corporation is concentrating its R&D efforts on developing AI technologies. Dell wants to provide cutting-edge products that satisfy changing consumer needs. Dell’s competitive advantage is strengthened by its R&D spending. New products and product improvements are driven by the emphasis on AI research. Dell’s dedication to innovation guarantees consistent growth and leadership in the market.

Future Projections and Growth Strategies

Expected Impact of AI on Revenue

● Short-term Projections

Dell anticipates a swift impact from AI investments. The company expects AI-driven solutions to enhance operational efficiency. AI technology will likely improve customer experiences. New revenue streams may emerge as businesses adopt AI. A report on AI use cases highlights potential revenue growth across sectors. Dell’s strategic focus on AI aligns with these industry trends.

● Long-term Growth Potential

The long-term potential of AI remains significant for Dell. AI technologies promise to transform various industries. Dell aims to leverage AI for sustained growth. The company’s commitment to AI research supports this vision. Industry analysts predict substantial growth in AI applications. Dell’s strategic investments position the company to capitalize on these opportunities.

Strategic Insights for Sustained Growth

● Diversification of Product Portfolio

Dell plans to diversify its product offerings. The company seeks to expand beyond traditional storage solutions. AI and emerging technologies play a crucial role in this strategy. Diversification enhances Dell’s ability to meet evolving market demands. A broader portfolio strengthens Dell’s competitive position.

● Expansion into Emerging Markets

Emerging markets present significant growth opportunities for Dell. The company targets regions with increasing demand for technology solutions. Dell’s focus on AI aligns with the needs of these markets. Expansion strategies include partnerships and local investments. Dell aims to establish a strong presence in these regions.

Conclusion

Dell Technologies is facing difficulties since its storage revenue is falling. A viable avenue for future expansion is provided by the strategic focus on AI. The business believes AI-driven solutions will increase operational effectiveness and create new sources of income. Dell’s updated revenue forecast, which ranges from $93.5 billion to $97.5 billion, shows that the market for AI is expected to grow.

As for Dell storage, Dell PowerVault MD38XX Series are recomended, which delivers high performance and scalability for demanding workloads. Supporting up to 64 hosts and 1.92PB of raw capacity, it offers robust data throughput, automated tiering, and dynamic disk pools for optimized performance. With features like high availability, versatile connectivity, and intuitive management software, the MD38XX series ensures reliable, efficient, and flexible storage solutions for growing enterprises.

Visit >>>Router-switch.com for further insights.

Expertise Builds Trust

20+ Years • 200+ Countries • 21500+ Customers/Projects

CCIE · JNCIE · NSE7 · ACDX · HPE Master ASE · Dell Server/AI Expert